What is deferred income?

"Deferred income (also known as deferred revenue, unearned revenue, or unearned income) is, in accrual accounting, money received for goods or services which have not yet been delivered”.

Source: Wikipedia

Why is the dry-cleaning profession concerned by the deferred income?

For a certain time, dry-cleaner’s are used to ask for the payment of a service when customers drop off their clothes. But as the service has not been performed yet, the amount paid may be considered as a down payment for a work to come.

In reality and according to applicable accounting and tax regulations, these amounts can be considered as turnover, but an inventory must be done at the end of the financial year. This in order to determine the amount of work that will be done during the next financial year, and to count it as deferred income at the closure of the current financial year.

The amounts at stake are relatively low. They represent one or two days of deposits at most. These values even out from one year to another, the accounting and tax repercussion is weak. Finally, the turnover recorded and the VAT paid are simply accounting entries in current year and previous year. We return the deferred income in the previous year, and we remove the deferred income in the current year. Turnover variations are never significant.

Most of the dry-cleaning stores define their turnover on the basis of their cash collection, with no consideration of this notion of deferred income. This works very well.

However, a new operating mode changes this notion. The system of customer cards with prepaid recharge: these cards are used as preloaded payment cards.

In the case of payment at the deposit, the items are dropped off and the service to perform is predefined, so it is possible to generate the turnover split in the right accounts: internal services, external services such as laundry, leather or carpets. It can get more complicated sometimes, because part of the production may be performed either internally or externally depending on the workload. However, this choice may not be clearly defined when clothes are dropped off, but only when the service is performed. In that case, we end up with an “irregularity” in the accounting distribution of the turnover. This will have an impact on the profit & loss report analysis during the calculation of the profit achieved on external services…

With the prepayment cards, it is impossible to know the final destination and which services will be performed when the clothes are dropped off. Then, it is impossible to split the amounts paid into the right accounts.

How to manage deferred income in accounting?

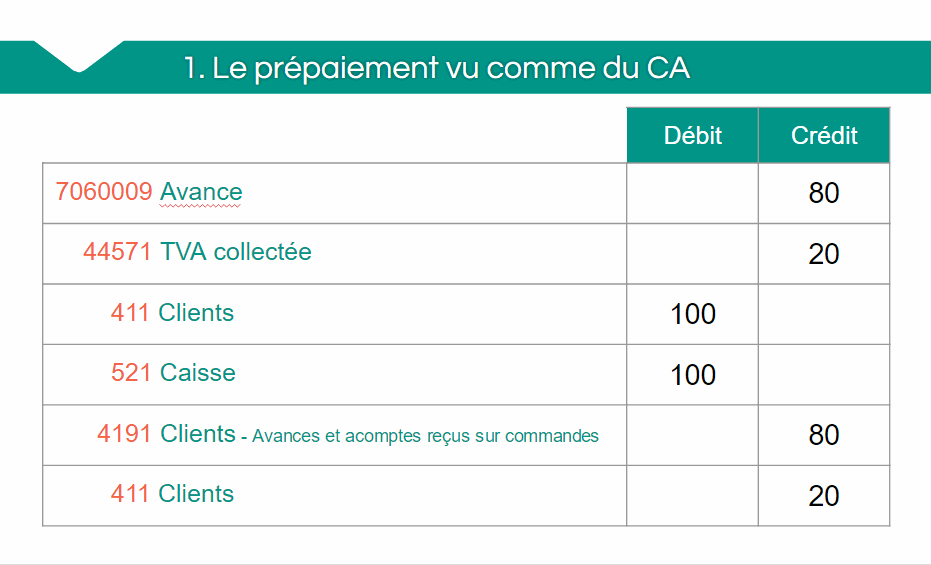

1. The prepayment is seen as turnover and generates VAT

It will be considered as an advance on works to come. So the customer needs to be provided with an advance “invoice”.

Example of distribution for €100 paid

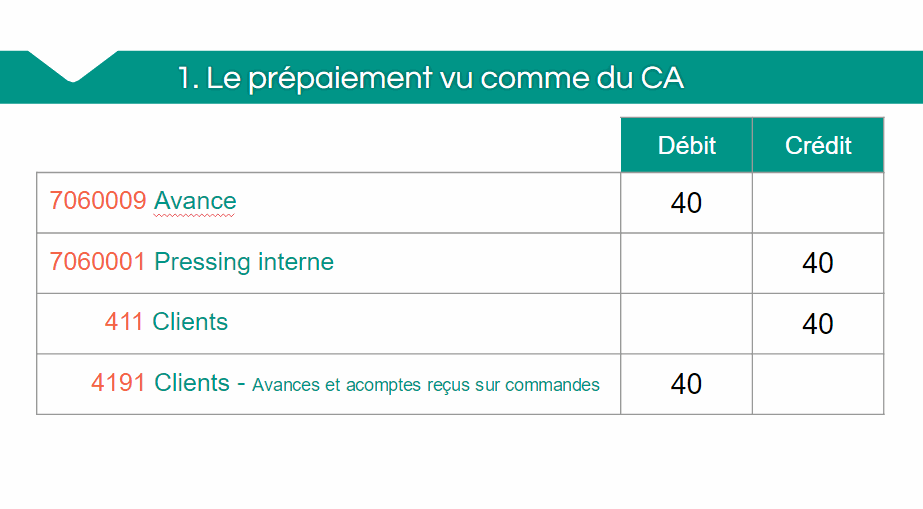

We can see that the accounting entry is complex and involves mechanisms hardly understandable and manageable by novices in general accounting. In this case, the turnover is immediately entered into the accounts, the account receivables allow the follow-up of available balance. Once the work has been done, the accounts will be correctly distributed. That way, the turnover distribution is always perfectly right. Here, the deferred income will be the amount at the end of the financial year of the account 7060009 Advance.

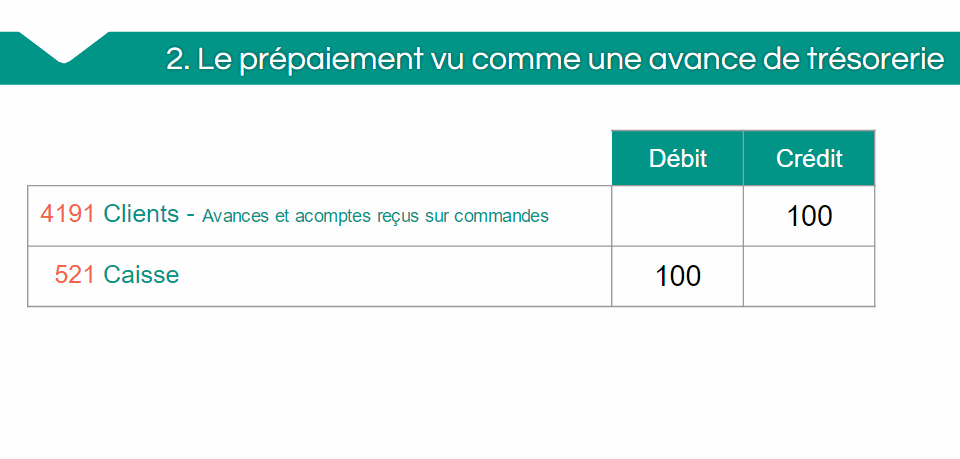

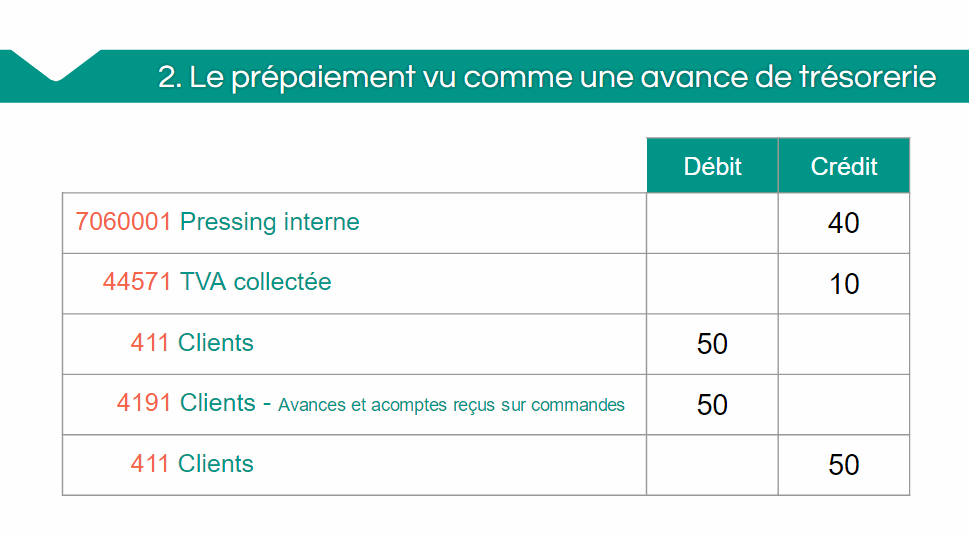

2. The prepayment is seen as a treasury advance, which is not turnover, and doesn’t generate VAT

Example of distribution for €100 paid

Here, the accounting entry is clearly less complex. The turnover is not recorded when the prepaid amounts are charged, but when the service is recorded. Fiscally speaking, there is no deferred income, because the amounts collected as down payments don’t appear in accounts of class 7, so they are outside of the profit & loss report. However, the account receivables can show a highly positive balance that can create a financial imbalance in the balance sheet.

What about VAT?

With the first method, the VAT is calculated and paid during cash collection. So this VAT is paid before the services are performed.

With the second method, the VAT is calculated and payable only after the services have been performed.

>> Considering this, we can affirm that the second method offers more benefit to the company.

Which method should we use?

Both methods are valid, but the first one is more complex and technical.

The main advantage of the first method is that it allows to keep the old “habits” of the profession, i.e. considering the amount in the cash-drawer as turnover.

But technically, the second method is “fairer”. It only requires to get to know the accounting mechanisms and to understand the difference between the invoiced turnover and the cash collection, which are two separate notions.

In both cases, your accounting management will be greatly simplified thanks to the use of a cash management software.

Advantages

Drawbacks

Advantages

Drawbacks

What to do with the amounts not consumed by the customers?

In some cases, the company can offer an extra recharge. For a certain amount, the company adds a free amount. For example, for 100 paid, the company offers 10. The customer will have a credit of 110.

In this case, if he has consumed 50 for example, he will still have 60 available. But should we consider that he fully owns 60, whereas the company offered 10? The answer is not easy.

Both positions are valid: the customer owns only what he really paid for, and what has been offered to me belongs fully to me. There is then a conflict of interest between the supplier and the customer. In terms of customer relationship management, this is an awkward situation which is not at the advantage of the supplier. Here, you need to adopt the solution that best fits the reality and the need for the company to have a sane and happy to consume customer base. A refund request of the balance from a customer is very rare. Dithering about the amount to refund will systematically generate a useless dissatisfaction, which will damage the reputation of the store.

To avoid this difficulty, a new approach consists in implementing a specific attractive price for customers with a positive balance instead of offering extra recharge. This a clearer on both aspects: accounting and sales.

Conclusion

Authors: Pascal Berardozzi, in collaboration with Jean-Marie Pavillet Accounting Director

Dry-cleaning: how to optimize the deferred income management?